Do Real Estate Agents Qualify For Qualified Business Income Deduction . fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. This question has entered the spotlight with. Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in 2021) are. is a rental real estate activity considered a trade or business for tax purposes, or merely an investment? the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their employees. irc §199a allows qualifying business owners to deduct 20% of qualified business income (qbi) before calculating income tax due on their. the deduction generally provides owners, shareholders, or partners a 20% deduction on their personal tax returns on.

from www.chegg.com

Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in 2021) are. is a rental real estate activity considered a trade or business for tax purposes, or merely an investment? This question has entered the spotlight with. irc §199a allows qualifying business owners to deduct 20% of qualified business income (qbi) before calculating income tax due on their. the deduction generally provides owners, shareholders, or partners a 20% deduction on their personal tax returns on. fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their employees.

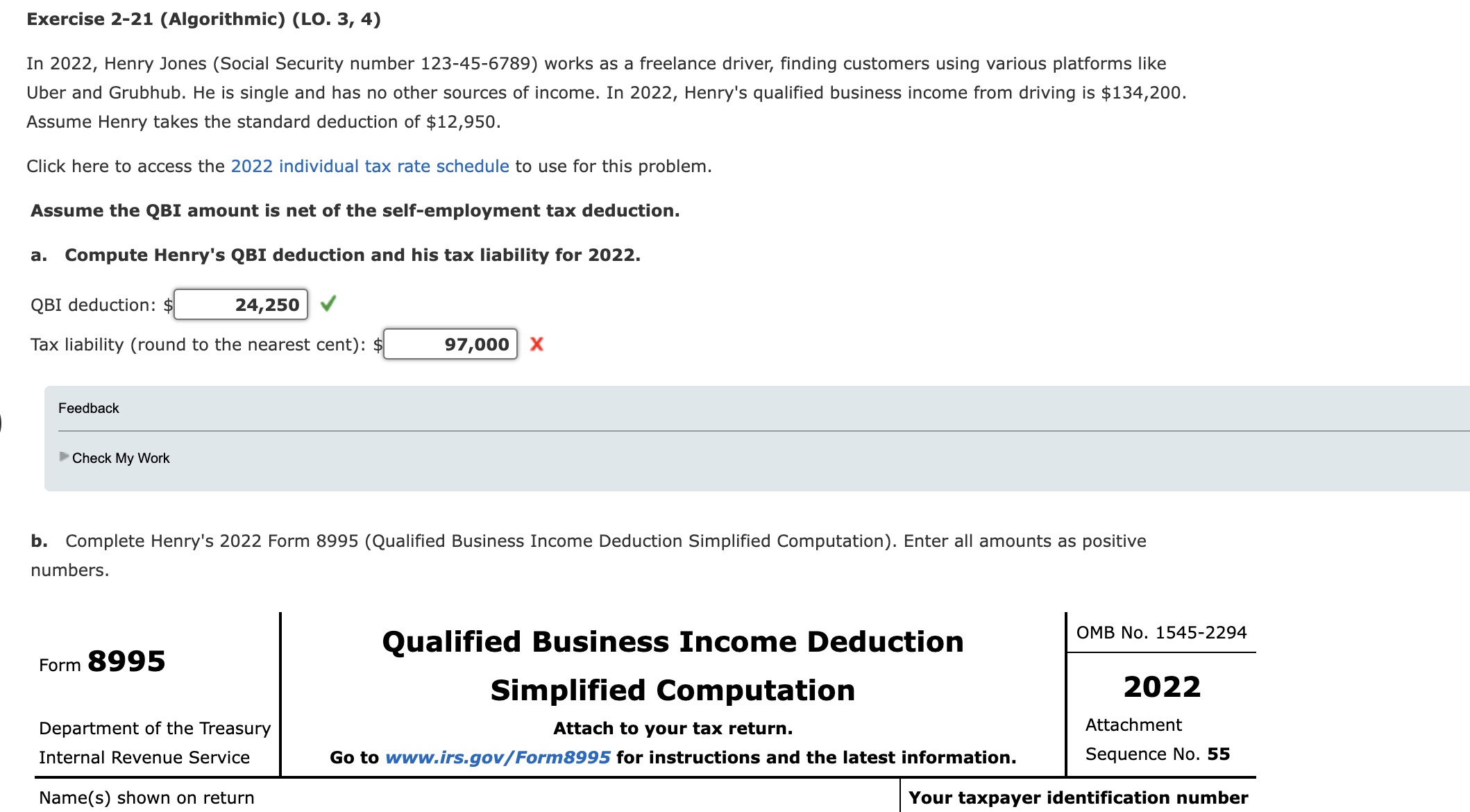

b. Henry's 2022 Form 8995 (Qualified

Do Real Estate Agents Qualify For Qualified Business Income Deduction the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their employees. This question has entered the spotlight with. the deduction generally provides owners, shareholders, or partners a 20% deduction on their personal tax returns on. irc §199a allows qualifying business owners to deduct 20% of qualified business income (qbi) before calculating income tax due on their. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. is a rental real estate activity considered a trade or business for tax purposes, or merely an investment? Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in 2021) are.

From ilovescan.com

What Do Real Estate Agents Make? and Earnings Do Real Estate Agents Qualify For Qualified Business Income Deduction fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in 2021) are. This question has entered the spotlight with. all employers are required by. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From anderscpa.com

Does Your Rental Real Estate Qualify for the 20 QBI Deduction Do Real Estate Agents Qualify For Qualified Business Income Deduction irc §199a allows qualifying business owners to deduct 20% of qualified business income (qbi) before calculating income tax due on their. This question has entered the spotlight with. fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. the deduction generally provides. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From aghlc.com

Qualified Business Deduction Flowchart Do Real Estate Agents Qualify For Qualified Business Income Deduction the deduction generally provides owners, shareholders, or partners a 20% deduction on their personal tax returns on. fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. is a rental real estate activity considered a trade or business for tax purposes, or. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From lifepointfd.com

Dramatically reduce taxes by qualifying as a real estate professional Do Real Estate Agents Qualify For Qualified Business Income Deduction the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. is a rental real estate activity considered a trade or business for tax purposes, or merely an investment? irc §199a allows qualifying business owners to deduct 20% of qualified business. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From anderscpa.com

Qualifying as a Real Estate Professional May Be Harder Than You Think Do Real Estate Agents Qualify For Qualified Business Income Deduction the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. irc §199a allows qualifying business. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From licenseclassroom.com

How Much Do Texas Real Estate Agents Make? License Classroom Do Real Estate Agents Qualify For Qualified Business Income Deduction This question has entered the spotlight with. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. irc §199a allows qualifying business owners to deduct 20% of qualified business income (qbi) before calculating income tax due on their. all employers. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From www.cpa-cm.com

2022 Industry Planning Rental Real Estate as Qualified Business Do Real Estate Agents Qualify For Qualified Business Income Deduction Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in 2021) are. fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. is a rental real estate activity considered a trade or business for. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From bayshorecpas.com

Your Rental Real Estate May Qualify For Deduction Bayshore CPA's Do Real Estate Agents Qualify For Qualified Business Income Deduction the deduction generally provides owners, shareholders, or partners a 20% deduction on their personal tax returns on. Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in 2021) are. all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From learningfaunicznydi.z21.web.core.windows.net

Qualified Business Deduction Worksheets Do Real Estate Agents Qualify For Qualified Business Income Deduction the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their employees. is a rental real estate activity considered a trade. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From www.thinkmint.ng

How to Market yourself as a Qualified Real Estate Agent Buy Real Estate Do Real Estate Agents Qualify For Qualified Business Income Deduction Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in 2021) are. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. the deduction generally provides owners, shareholders, or partners a 20%. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From soundcloud.com

Stream episode REPS 02 How You Can Offset W2 & Active Business Do Real Estate Agents Qualify For Qualified Business Income Deduction is a rental real estate activity considered a trade or business for tax purposes, or merely an investment? irc §199a allows qualifying business owners to deduct 20% of qualified business income (qbi) before calculating income tax due on their. Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From www.tffn.net

How Much Do Real Estate Agents Make? Exploring Salaries and Factors Do Real Estate Agents Qualify For Qualified Business Income Deduction all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their employees. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. fortunately, section 199a shows favor to the real estate. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From gkh.com

Rental Real Estate and the Qualified Business Tax Deduction Do Real Estate Agents Qualify For Qualified Business Income Deduction the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. This question has entered the spotlight with. all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their employees. the deduction. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From blog.redpathcpas.com

Qualifying a Rental Real Estate Operation for the 199A Deduction Do Real Estate Agents Qualify For Qualified Business Income Deduction is a rental real estate activity considered a trade or business for tax purposes, or merely an investment? all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their employees. Taxpayers having taxable income less than a specific amount ($164,900 for single filers and $329,800 for joint filers in. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From entryeducation.edu.au

How to a real estate agent in Australia Your Guide Do Real Estate Agents Qualify For Qualified Business Income Deduction This question has entered the spotlight with. is a rental real estate activity considered a trade or business for tax purposes, or merely an investment? fortunately, section 199a shows favor to the real estate industry in its definition of a “qualified trade or business.” specifically carved out in the definitions. the deduction generally provides owners, shareholders, or. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From seekingalpha.com

Update On The Qualified Business Deduction For Individuals Do Real Estate Agents Qualify For Qualified Business Income Deduction the deduction generally provides owners, shareholders, or partners a 20% deduction on their personal tax returns on. This question has entered the spotlight with. the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. Taxpayers having taxable income less than a. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From amynorthardcpa.com

How to Make Your Rental Property Qualify for the QBI Deduction Do Real Estate Agents Qualify For Qualified Business Income Deduction is a rental real estate activity considered a trade or business for tax purposes, or merely an investment? the deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20 percent of qualified real estate investment trust (reit) dividends and qualified. This question has entered the spotlight with. the deduction generally provides owners,. Do Real Estate Agents Qualify For Qualified Business Income Deduction.

From www.youtube.com

The Top Tax Strategy for Real Estate Qualified Business Do Real Estate Agents Qualify For Qualified Business Income Deduction all employers are required by law to deduct cpp contributions and ei premiums from most amounts they pay to their employees. This question has entered the spotlight with. irc §199a allows qualifying business owners to deduct 20% of qualified business income (qbi) before calculating income tax due on their. fortunately, section 199a shows favor to the real. Do Real Estate Agents Qualify For Qualified Business Income Deduction.